EXHIBIT 99.1

Published on May 24, 2019

Exhibit 99.1

IntroductionDallas-based RAVE Restaurant Group is a holding company for the Pizza

Inn, Pie Five and PIE brands. Pizza Inn is an international pizza chain that has served customers since 1958; Pie Five is a leader in the rapidly growing fast-casual pizza space; and PIE, RAVE’s newest brand, is a kiosk pizza concept geared

towards non-traditional locations.HighlightsLarge, Growing Market. RAVE’s market is large and growing. According to the 2019 Pizza Power Report1, 83% of Americans eat pizza at least once a month and the nearly $145 billion worldwide market

for pizza is projected to grow more than 10% annually over the next five years.Decades of Experience. During its more than six decades in the pizza business, RAVE has proven adept at responding to changes in consumer preferences and

industry trends while maintaining its brands’ authenticity.New Management Team. Since the beginning of 2017, RAVE’s management team has been strengthened by the naming of experienced restaurant industry executives to key leadership

positions, beginning with Chief Executive Officer (CEO) Scott Crane, who previously served as President and CEO of the high-growth, fast-casual dining company Smashburger.Strategic Initiatives Driving Positive Change. This new team

implemented strategic initiatives that have expanded RAVE’s potential market, reinvigorated sales growth, reduced sales volatility, cut overhead, lowered capital requirements and strengthened the balance sheet. Key initiatives include

streamlining corporate operations, implementing restaurant-level changes to drive sales, introducing new restaurant formats, and strengthening the balance sheet.Streamlining Corporate Operations. Among the steps taken to streamline

corporate operations were discontinuing the distribution division, closing underperforming restaurants, re-franchising owned restaurants, and upgrading technology. They resulted in a simpler business model with less volatility and greater

predictability, reduced credit risk and lower costs.Restaurant-Level Sales Drivers. At the restaurants, the rollout of revenue-enhancing products and services, such as online ordering; customer loyalty programs; new menu items; and an

enhanced store remodel program, are driving improved performance.New Innovative Restaurant Formats. With the launch of a new brand, PIE, for non-traditional locations and a more cost- efficient “Goldilocks” Pie Five format, RAVE franchisees

have options to serve the full range of market opportunities. PIE’s recently announced collaboration with Fortier, Inc., the nation's leading supplier of store equipment to the convenience store and food services industries, allows PIE to

have a notable presence in markets that it otherwise wouldn’t be able to access.Strong Financial Position. RAVE’s financial position has strengthened significantly since Scott Crane became CEO as a result of actions taken to boost working

capital, reduce ongoing capital requirements and raise equity, among them closing the distribution division and issuing equity and convertible debt.Positive Financial Trends. The initial success of the strategic initiatives is reflected in

recent financial results: nine consecutive quarters of growth in domestic comparable-store retail sales at Pizza Inn and positive year-over-year swings in net income, earnings per share, cash flow provided by operations and Adjusted EBITDA2

in the third quarter and first nine months of fiscal 2019.Substantial Unit-Growth Potential. Improving restaurant performance and the rollout of new store formats have contributed to interest in new restaurant development from existing and

new franchisees. As a result, management targets annual new unit growth of 10% at both Pizza Inn and Pie Five over the next three years.Substantial Insider Ownership. Directors and executive officers own approximately 48% of RAVE’s

outstanding common stock. Page 1 of 16 RAVE Restaurant Group Inc.(NASDAQ: RAVE)Sally Wallick, CFA 404-806-1398swallick@renmarkfinancial.com May 2019

May 2019 Company HistoryRAVE has offered consumers affordable, high quality pizza since

1958, when brothers Joe and R. L. Spillman opened the first Pizza Inn restaurant in Dallas, Texas. Pizza Inn awarded the first domestic franchise in 1963 and opened the first Pizza Inn buffet restaurant in 1969. The Company began

franchising the Pizza Inn brand internationally in the late 1970s. In 2011, RAVE opened the first Pie Five restaurant in Ft. Worth, Texas, and, in 2012, signed its first franchise development agreement for Pie Five. In 2018, RAVE launched

the PIE kiosk and convenience store format to meet consumer demand for tasty, high-quality pizzas in a grab-and-go delivery model.In 1993, Pizza Inn Holdings, Inc. began trading on the NASDAQ Stock Market under the ticker symbol "PZZI." In

2015, the Company became RAVE Restaurant Group, Inc., which reflected its transformation from a single-brand to a multi-brand restaurant company. RAVE Restaurant Group is traded on the NASDAQ Capital Market under the ticker symbol

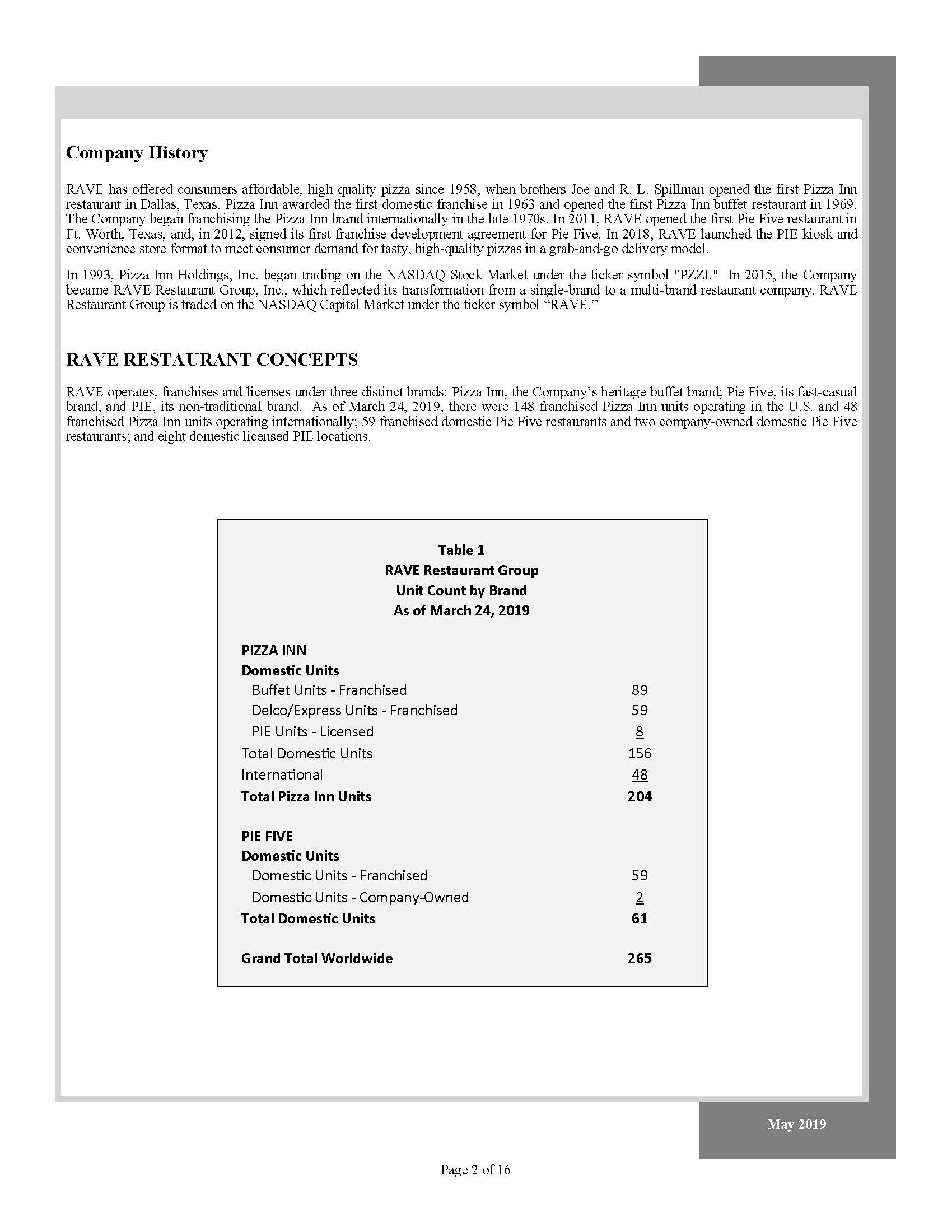

“RAVE.”RAVE RESTAURANT CONCEPTSRAVE operates, franchises and licenses under three distinct brands: Pizza Inn, the Company’s heritage buffet brand; Pie Five, its fast-casual brand, and PIE, its non-traditional brand. As of March 24, 2019,

there were 148 franchised Pizza Inn units operating in the U.S. and 48 franchised Pizza Inn units operating internationally; 59 franchised domestic Pie Five restaurants and two company-owned domestic Pie Five restaurants; and eight domestic

licensed PIE locations. Table 1RAVE Restaurant Group Unit Count by Brand As of March 24, 2019PIZZA INNDomestic UnitsBuffet Units ‐

Franchised Delco/Express Units ‐ FranchisedPIE Units ‐ LicensedTotal Domestic Units InternationalTotal Pizza Inn Units 8959815648204 PIE FIVEDomestic UnitsDomestic Units ‐ FranchisedDomestic

Units ‐ Company‐OwnedTotal Domestic Units 59261 Grand Total Worldwide 265 Page 1 of 16

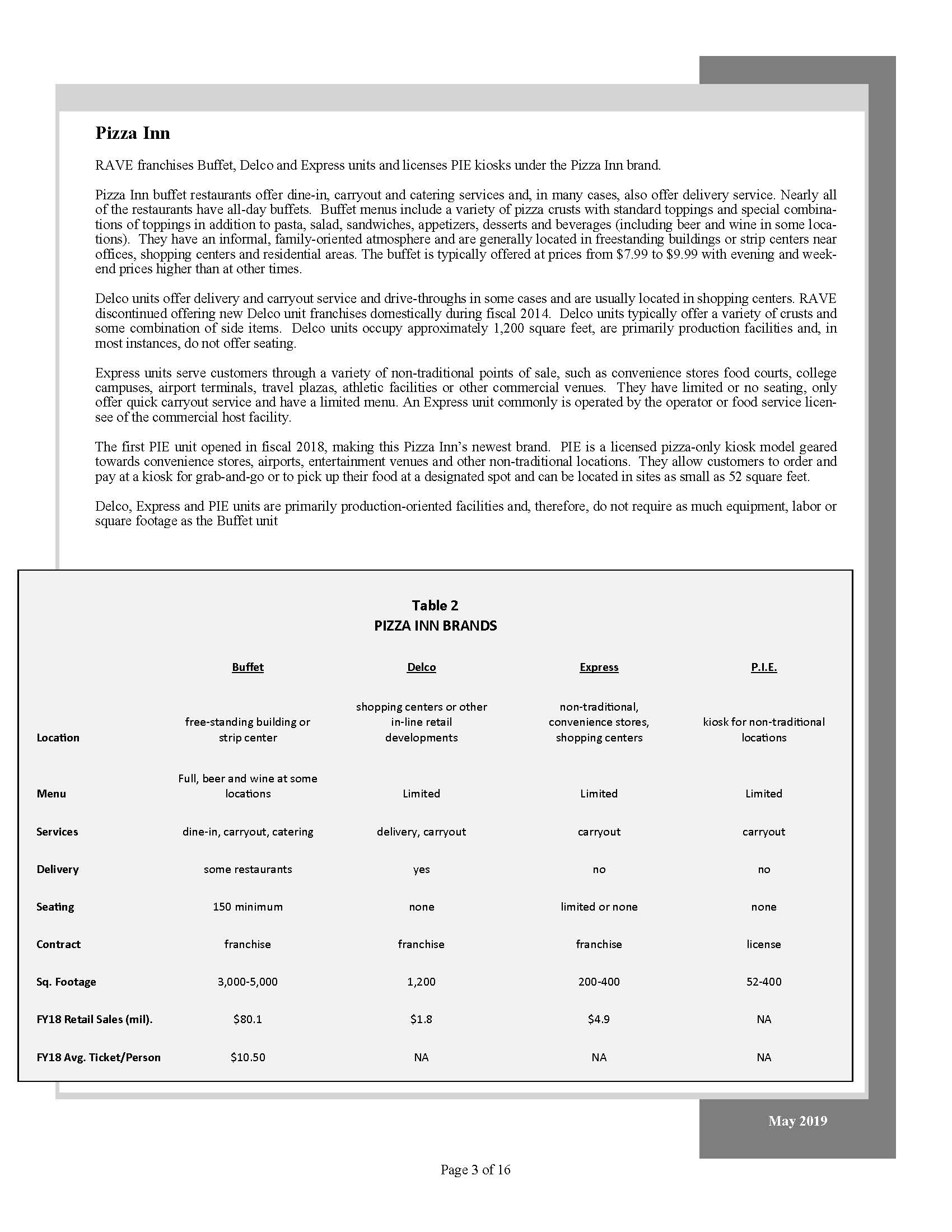

May 2019 Pizza InnRAVE franchises Buffet, Delco and Express units and licenses PIE

kiosks under the Pizza Inn brand.Pizza Inn buffet restaurants offer dine-in, carryout and catering services and, in many cases, also offer delivery service. Nearly all of the restaurants have all-day buffets. Buffet menus include a variety

of pizza crusts with standard toppings and special combina- tions of toppings in addition to pasta, salad, sandwiches, appetizers, desserts and beverages (including beer and wine in some loca- tions). They have an informal, family-oriented

atmosphere and are generally located in freestanding buildings or strip centers near offices, shopping centers and residential areas. The buffet is typically offered at prices from $7.99 to $9.99 with evening and week- end prices higher

than at other times.Delco units offer delivery and carryout service and drive-throughs in some cases and are usually located in shopping centers. RAVE discontinued offering new Delco unit franchises domestically during fiscal 2014. Delco

units typically offer a variety of crusts and some combination of side items. Delco units occupy approximately 1,200 square feet, are primarily production facilities and, in most instances, do not offer seating.Express units serve customers

through a variety of non-traditional points of sale, such as convenience stores food courts, college campuses, airport terminals, travel plazas, athletic facilities or other commercial venues. They have limited or no seating, only offer

quick carryout service and have a limited menu. An Express unit commonly is operated by the operator or food service licen- see of the commercial host facility.The first PIE unit opened in fiscal 2018, making this Pizza Inn’s newest brand.

PIE is a licensed pizza-only kiosk model geared towards convenience stores, airports, entertainment venues and other non-traditional locations. They allow customers to order and pay at a kiosk for grab-and-go or to pick up their food at a

designated spot and can be located in sites as small as 52 square feet.Delco, Express and PIE units are primarily production-oriented facilities and, therefore, do not require as much equipment, labor or square footage as the Buffet

unit Table 2 PIZZA INN BRANDS Buffet Delco Express P.I.E. Location free‐standing building or strip center shopping centers or other

in‐line retail developments non‐traditional, convenience stores, shopping centers kiosk for non‐traditional locations Menu Full, beer and wine at some

locations Limited Limited Limited Services dine‐in, carryout, catering delivery, carryout carryout carryout Delivery some

restaurants yes no no Seating 150 minimum none limited or

none none Contract franchise franchise franchise license Sq. Footage 3,000‐5,000 1,200 200‐400 52‐400 FY18 Retail

Sales (mil). $80.1 $1.8 $4.9 NA FY18 Avg. Ticket/Person $10.50 NA NA NA Page 1 of 16

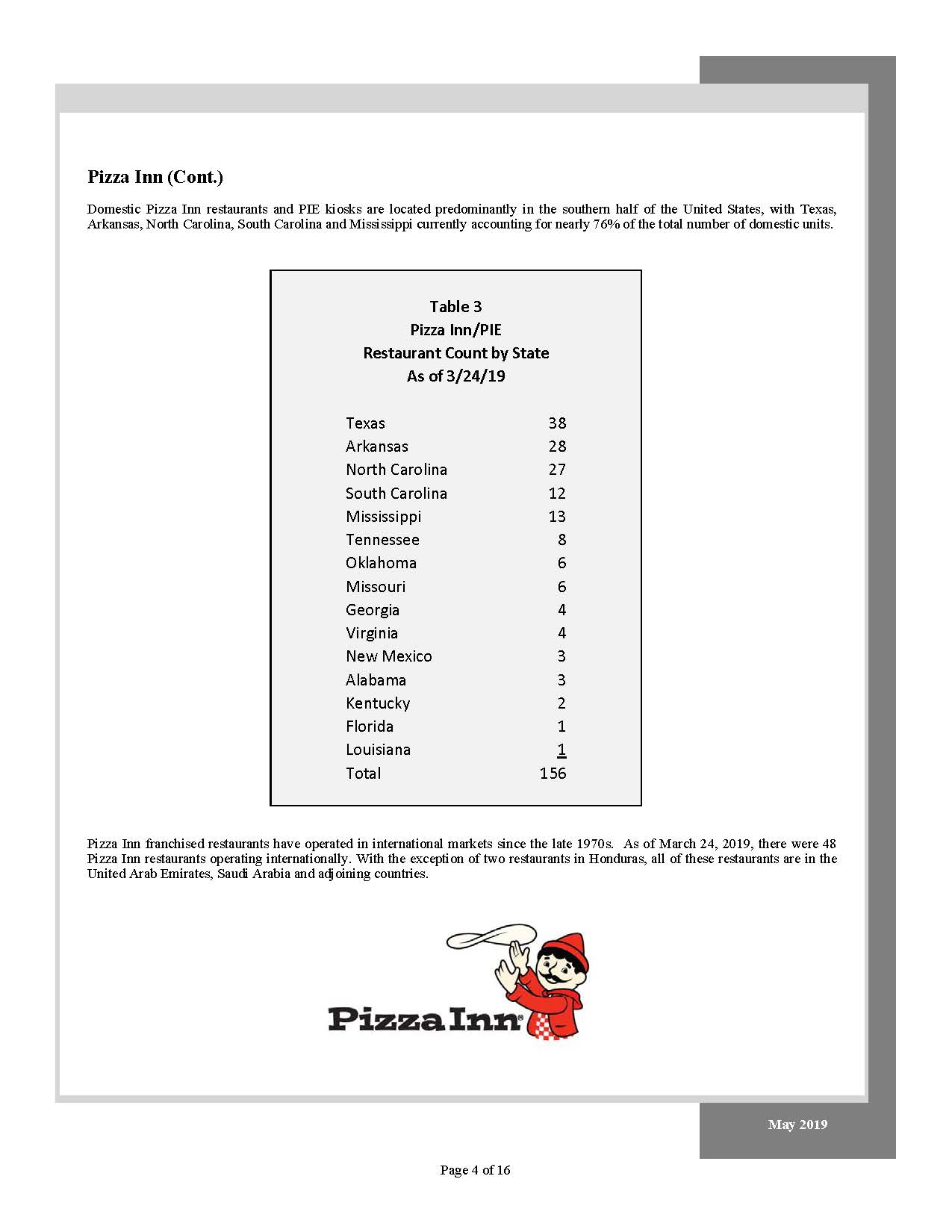

Pizza Inn (Cont.)Domestic Pizza Inn restaurants and PIE kiosks are located predominantly

in the southern half of the United States, with Texas, Arkansas, North Carolina, South Carolina and Mississippi currently accounting for nearly 76% of the total number of domestic units. Pizza Inn franchised restaurants have operated in

international markets since the late 1970s. As of March 24, 2019, there were 48 Pizza Inn restaurants operating internationally. With the exception of two restaurants in Honduras, all of these restaurants are in the United Arab Emirates,

Saudi Arabia and adjoining countries. Table 3 Pizza Inn/PIERestaurant Count by State As of

3/24/19 TexasArkansas 3828 North Carolina 27 South

Carolina 12 Mississippi 13 Tennessee 8 Oklahoma 6 Missouri 6 Georgia 4 Virginia 4 New Mexico 3 Alabama 3 Kentucky 2 Florida 1 Louisiana 1 Total 156 May 2019 Page 4 of 16

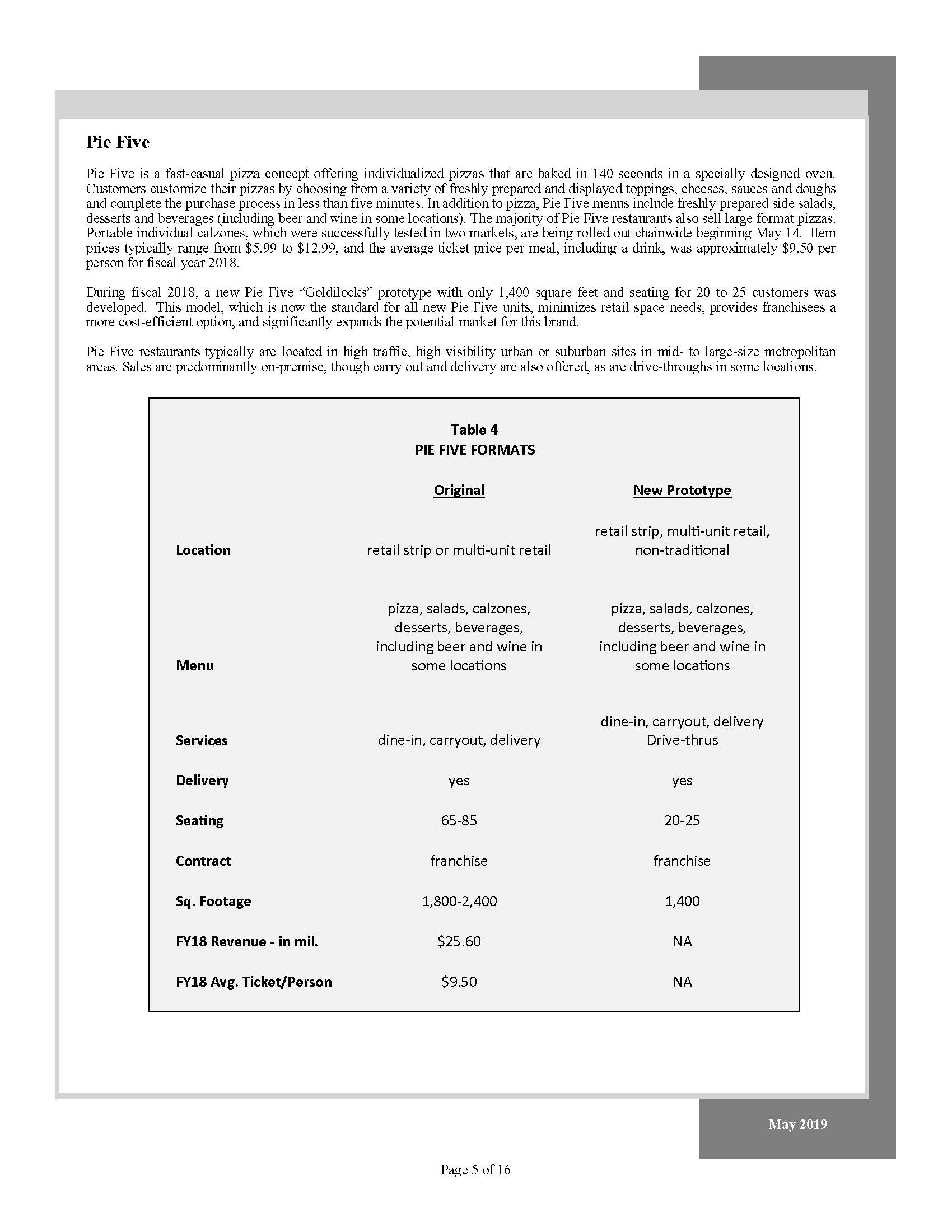

Pie FivePie Five is a fast-casual pizza concept offering individualized pizzas that are

baked in 140 seconds in a specially designed oven. Customers customize their pizzas by choosing from a variety of freshly prepared and displayed toppings, cheeses, sauces and doughs and complete the purchase process in less than five

minutes. In addition to pizza, Pie Five menus include freshly prepared side salads, desserts and beverages (including beer and wine in some locations). The majority of Pie Five restaurants also sell large format pizzas. Portable individual

calzones, which were successfully tested in two markets, are being rolled out chainwide beginning May 14. Item prices typically range from $5.99 to $12.99, and the average ticket price per meal, including a drink, was approximately $9.50

per person for fiscal year 2018.During fiscal 2018, a new Pie Five “Goldilocks” prototype with only 1,400 square feet and seating for 20 to 25 customers was developed. This model, which is now the standard for all new Pie Five units,

minimizes retail space needs, provides franchisees a more cost-efficient option, and significantly expands the potential market for this brand.Pie Five restaurants typically are located in high traffic, high visibility urban or suburban

sites in mid- to large-size metropolitan areas. Sales are predominantly on-premise, though carry out and delivery are also offered, as are drive-throughs in some locations. Table 4PIE FIVE

FORMATSOriginal New Prototype Location retail strip or multi‐unit retail retail strip, multi‐unit retail, non‐traditional Menu pizza, salads, calzones, desserts, beverages, including

beer and wine in some locations pizza, salads, calzones, desserts, beverages, including beer and wine in some locations Services dine‐in, carryout, delivery dine‐in, carryout, delivery

Drive‐thrus Delivery yes yes Seating 65‐85 20‐25 Contract franchise franchise Sq. Footage 1,800‐2,400 1,400 FY18

Revenue ‐ in mil. $25.60 NA FY18 Avg. Ticket/Person $9.50 NA May 2019 Page 4 of 16

Pie Five (Cont.)Pie Five restaurants are less concentrated geographically than Pizza

Inn restaurants, as shown in Table 5. Table 5 Pie FiveRestaurant Count by State As of

3/24/19 TexasKansas 139 Tennessee 8 Maryland 7 Oklahoma 5 Missouri 4 Arkansas 2 Georgia 2 Kentucky 2 Florida 1 California 1 Iowa 1 Mississippi 1 Alabama 1 Illinois 1 Virginia 1 Delaware 1 Rhode

Island 1 Total 61 May 2019 Page 4 of 16

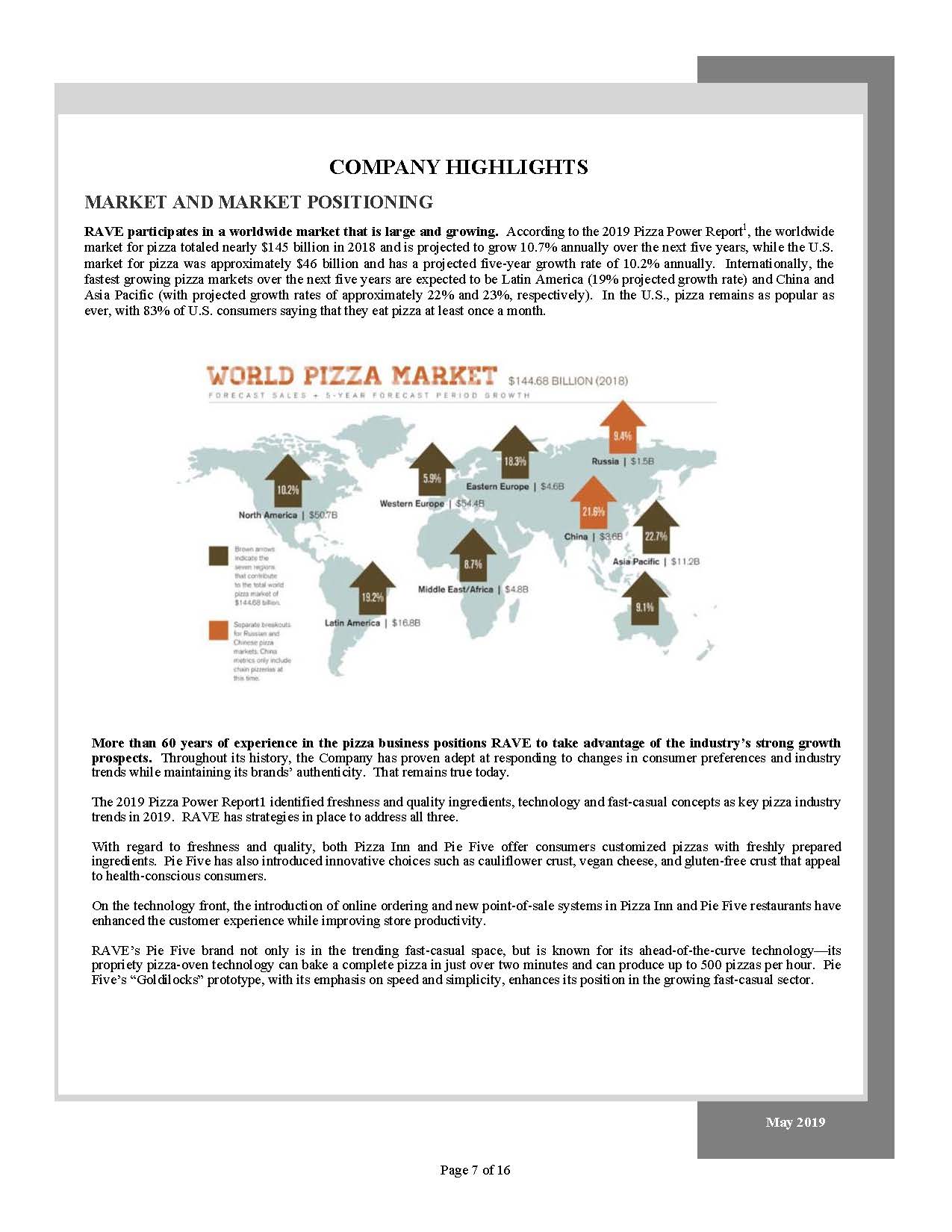

May 2019 COMPANY HIGHLIGHTSMARKET AND MARKET POSITIONINGRAVE participates in a

worldwide market that is large and growing. According to the 2019 Pizza Power Report1, the worldwide market for pizza totaled nearly $145 billion in 2018 and is projected to grow 10.7% annually over the next five years, while the U.S.

market for pizza was approximately $46 billion and has a projected five-year growth rate of 10.2% annually. Internationally, the fastest growing pizza markets over the next five years are expected to be Latin America (19% projected growth

rate) and China and Asia Pacific (with projected growth rates of approximately 22% and 23%, respectively). In the U.S., pizza remains as popular as ever, with 83% of U.S. consumers saying that they eat pizza at least once a month. More

than 60 years of experience in the pizza business positions RAVE to take advantage of the industry’s strong growth prospects. Throughout its history, the Company has proven adept at responding to changes in consumer preferences and industry

trends while maintaining its brands’ authenticity. That remains true today.The 2019 Pizza Power Report1 identified freshness and quality ingredients, technology and fast-casual concepts as key pizza industry trends in 2019. RAVE has

strategies in place to address all three.With regard to freshness and quality, both Pizza Inn and Pie Five offer consumers customized pizzas with freshly prepared ingredients. Pie Five has also introduced innovative choices such as

cauliflower crust, vegan cheese, and gluten-free crust that appeal to health-conscious consumers.On the technology front, the introduction of online ordering and new point-of-sale systems in Pizza Inn and Pie Five restaurants have enhanced

the customer experience while improving store productivity.RAVE’s Pie Five brand not only is in the trending fast-casual space, but is known for its ahead-of-the-curve technology—its propriety pizza-oven technology can bake a complete pizza

in just over two minutes and can produce up to 500 pizzas per hour. Pie Five’s “Goldilocks” prototype, with its emphasis on speed and simplicity, enhances its position in the growing fast-casual sector. Page 7 of 16

NEW MANAGEMENT TEAM, NEW GROWTH STRATEGIESSince the beginning of 2017, RAVE’s management team

has been strengthened with the naming of experienced restaurant industry executives to leadership positions.On January 9, 2017, Scott Crane was named RAVE’s CEO. Prior to joining RAVE, Mr. Crane was President and CEO of the high- growth

fast-casual dining company Smashburger. Under his leadership, Smashburger grew from a two-unit start up concept in 2007 to a global company with annual sales in excess of $350 million and more than 330 corporate and franchise locations in

35 states and seven countries. Previously, Mr. Crane was at Fugate Enterprises, Inc., one of the largest Pizza Hut franchisees in the U.S., where he oversaw the operation of 210 Pizza Hut units, in addition to Taco Bell, Wing Street, Sonic

and Blockbuster Video locations.On September 18, 2018, Bob Bafundo was named President of RAVE. In this position, he oversees day-to-day operations for all RAVE brands. Mr. Bafundo joined RAVE in 2016 as president of Pizza Inn, where he

developed and implemented successful initia- tives that have led to nine consecutive quarters of growth in domestic comparable-store retail sales and a resurgence in restaurant growth at Pizza Inn. He also spearheaded the introduction of a

new non-traditional Pizza Inn brand, PIE, as a complement to its other pizza restaurant concepts.On September 18, 2018, Andrea Allen was named Chief Accounting and Administrative Officer. In this role, she oversees all ac- counting, finance

and administrative needs for the Company. She joined RAVE in 2017 as Vice President of Accounting/Controller and has been instrumental in streamlining accounting processes through new technology initiatives and collaborating with Company

leaders on financial planning and reporting. Prior to joining RAVE, she served as Vice President of Procurement and Information Systems and Controller at Bar Louie, BL Restaurant Operations, and was a financial consultant for TGI

Fridays.After becoming RAVE’s CEO, Scott Crane introduced strategies that have expanded the Company’s potential market; rein- vigorated sales growth; strengthened the balance sheet; and reduced sales volatility, overhead, and capital

requirements. These strategic initiatives, which are discussed in more detail below, included: ing sales and operating performance, and the “Goldilocks” Pie Five format and Streamlining corporate operations,Implementing restaurant-level

initiatives aimed at enhancing the customer experience, boosting traffic, and improv-Introducing innovative pizza restaurant formats to expand RAVE’s potential markets, including a new brand, PIE,Strengthening RAVE’s financial position by

building cash and working capital balances, reducing liabilities, increas- ing shareholders’ equity, and lowering ongoing capital requirements.Streamlining Corporate OperationsIn the past two years, RAVE has streamlined corporate

operations, resulting in a simpler business model with less volatility and greater predictability, reduced credit risk and lowered costs. Key aspects of this strategic shift include discontinuing Norco, RAVE’s distribution division;

eliminating underperforming units; refranchising owned Pie Five restaurants; and in- troducing efficiency-enhancing technology upgrades.Discontinuing Distribution ServicesDuring the second quarter of fiscal 2018, RAVE discontinued its Norco

distribution division, which provided product sourcing, pur- chasing, and other services to the Pizza Inn and Pie Five restaurant systems, and revised its arrangements with third party suppliers and distributors of food, equipment and

supplies. Following the shutdown, franchisees and licensees began purchasing food and sup- plies directly from authorized, reputable and experienced supply and distribution companies. Closing the distribution division elimi- nated the

credit risk, overhead expense, and delivery responsibilities of directly supplying franchised restaurants and PIE kiosks.Pizza Inn and Pie Five purchases of food, equipment and supplies made from Norco were recognized as revenue and their

cost was included in cost of sales. As a result, after Norco was discontinued, revenue and cost of goods dropped sharply. However, the lost margin from Norco sales was largely offset by new supplier and distributor incentive revenues. As a

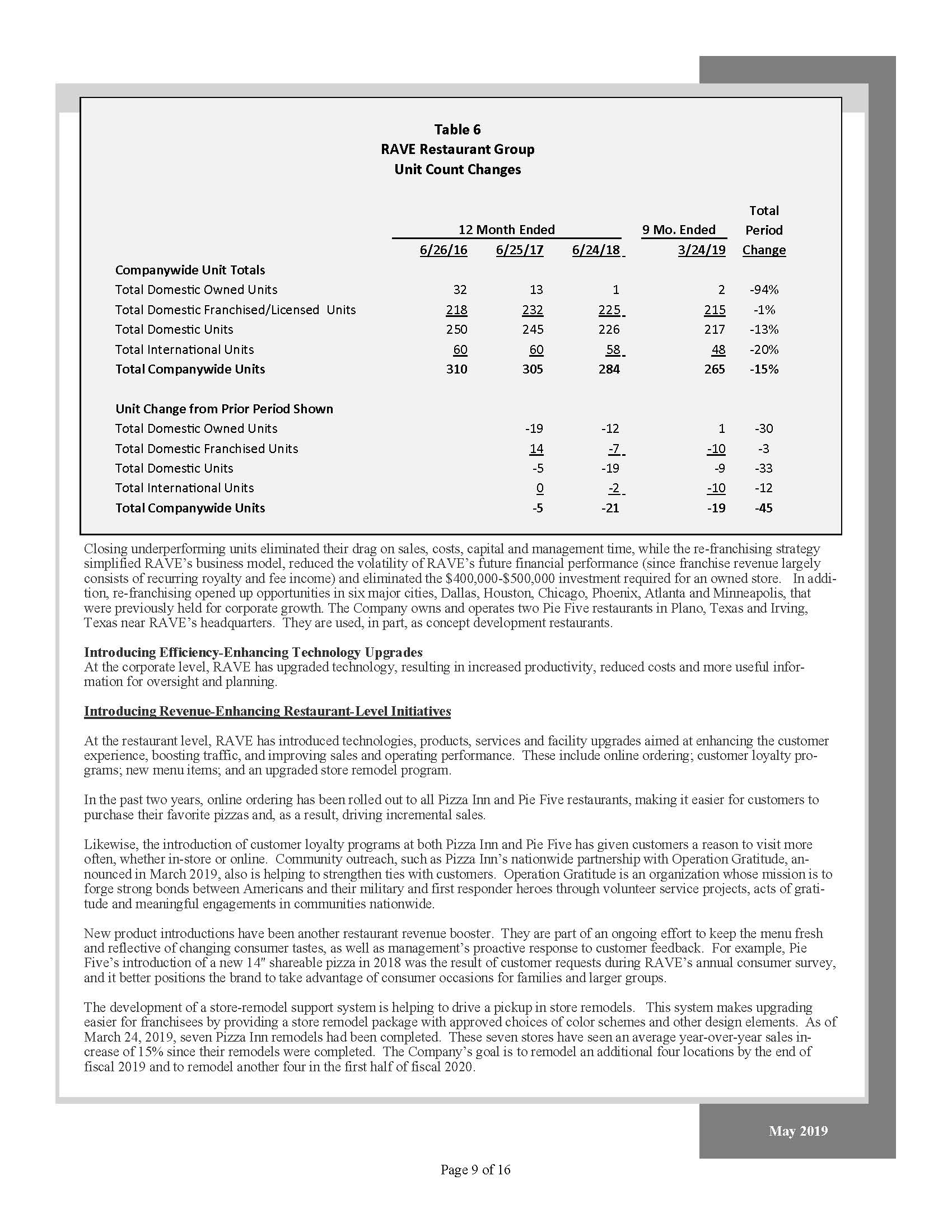

result, there was little effect on RAVE’s bottom line.Eliminating Underperforming Stores/Refranchising of Owned StoresDuring fiscal 2017 and 2018, RAVE took significant steps to rationalize its store base by closing underperforming units

and transfer- ring all but one Pie Five owned restaurant to the franchise model. This process has continued in fiscal 2019. As show in Table 6, RAVE’s total restaurant count declined by 45 units or 15% from the end of fiscal 2016 to the end

of the third quarter of fiscal 2019. During this period, the number of domestic owned restaurants fell by 30 units, while the number of domestic franchised units de- creased by three. May 2019 8

Closing underperforming units eliminated their drag on sales, costs, capital and management

time, while the re-franchising strategy simplified RAVE’s business model, reduced the volatility of RAVE’s future financial performance (since franchise revenue largely consists of recurring royalty and fee income) and eliminated the

$400,000-$500,000 investment required for an owned store. In addi- tion, re-franchising opened up opportunities in six major cities, Dallas, Houston, Chicago, Phoenix, Atlanta and Minneapolis, that were previously held for corporate growth.

The Company owns and operates two Pie Five restaurants in Plano, Texas and Irving, Texas near RAVE’s headquarters. They are used, in part, as concept development restaurants.Introducing Efficiency-Enhancing Technology UpgradesAt the

corporate level, RAVE has upgraded technology, resulting in increased productivity, reduced costs and more useful infor- mation for oversight and planning.Introducing Revenue-Enhancing Restaurant-Level InitiativesAt the restaurant level,

RAVE has introduced technologies, products, services and facility upgrades aimed at enhancing the customer experience, boosting traffic, and improving sales and operating performance. These include online ordering; customer loyalty pro-

grams; new menu items; and an upgraded store remodel program.In the past two years, online ordering has been rolled out to all Pizza Inn and Pie Five restaurants, making it easier for customers to purchase their favorite pizzas and, as a

result, driving incremental sales.Likewise, the introduction of customer loyalty programs at both Pizza Inn and Pie Five has given customers a reason to visit more often, whether in-store or online. Community outreach, such as Pizza Inn’s

nationwide partnership with Operation Gratitude, an- nounced in March 2019, also is helping to strengthen ties with customers. Operation Gratitude is an organization whose mission is to forge strong bonds between Americans and their

military and first responder heroes through volunteer service projects, acts of grati- tude and meaningful engagements in communities nationwide.New product introductions have been another restaurant revenue booster. They are part of an

ongoing effort to keep the menu fresh and reflective of changing consumer tastes, as well as management’s proactive response to customer feedback. For example, Pie Five’s introduction of a new 14" shareable pizza in 2018 was the result of

customer requests during RAVE’s annual consumer survey, and it better positions the brand to take advantage of consumer occasions for families and larger groups.The development of a store-remodel support system is helping to drive a pickup

in store remodels. This system makes upgrading easier for franchisees by providing a store remodel package with approved choices of color schemes and other design elements. As of March 24, 2019, seven Pizza Inn remodels had been completed.

These seven stores have seen an average year-over-year sales in- crease of 15% since their remodels were completed. The Company’s goal is to remodel an additional four locations by the end of fiscal 2019 and to remodel another four in the

first half of fiscal 2020. Table 6RAVE Restaurant Group Unit Count Changes 9 Mo. Ended Total Period 12 Month Ended 6/26/16 6/25/17

6/24/18 3/24/19 Change Companywide Unit TotalsTotal Domestic Owned UnitsTotal Domestic Franchised/Licensed Units Total Domestic

UnitsTotal International UnitsTotal Companywide Units 3221825060310 1323224560305 122522658284 2 ‐94%215 ‐1%217 ‐13%48 ‐20%265

‐15% Unit Change from Prior Period ShownTotal Domestic Owned Units Total Domestic Franchised Units Total Domestic UnitsTotal

International UnitsTotal Companywide Units ‐19 14‐5 0‐5 ‐12‐7‐19‐2‐21 1‐10‐9‐10‐19 ‐30‐3‐33‐12‐45 May 2019 9

Introducing Innovative Restaurant FormatsIn recent years, RAVE has expanded its portfolio of

pizza restaurant formats to include a new brand, PIE, and a new Pie Five format.The introduction of a new non-traditional brand, PIE, which is a complement to the brand refresh and expansion initiatives at Pizza Inn, represents an

incremental growth opportunity for Pizza Inn, by diversifying its footprint and expanding its customer reach to in- clude convenience stores, malls, travel centers, airports and other retail outlets. Convenience stores alone are a $575

billion industry with 70% of sales attributed to in-store purchases. PIE units can range from 52 to 400 square feet and are highly adaptable, which allows for creative deployment to sites that can’t accommodate a larger unit. Strong

interest from large multi-unit retailers domesti- cally and internationally enhances PIE’s growth prospects. As of March 24, 2019, there were eight PIE units in operation.Pie Five’s new prototype features a smaller footprint and reimagined

interior package, logo and menu. With labor and real estate cost concerns top of mind for restaurant operators, this “Goldilocks” format offers franchisees an affordable business model with lower startup costs and competitive returns. The

focus in these stores is on speed and simplicity, with an emphasis on off-premise sales, carryout, online ordering and third-party delivery. This format is now standard for all new Pie Five units and greatly expands their potential

market.With these additions, RAVE now has a full range of pizza-based formats from the smallest – kiosks – to the largest – full-sized restaurants – that can serve nearly any market from traditional stand-alone or retail development sites

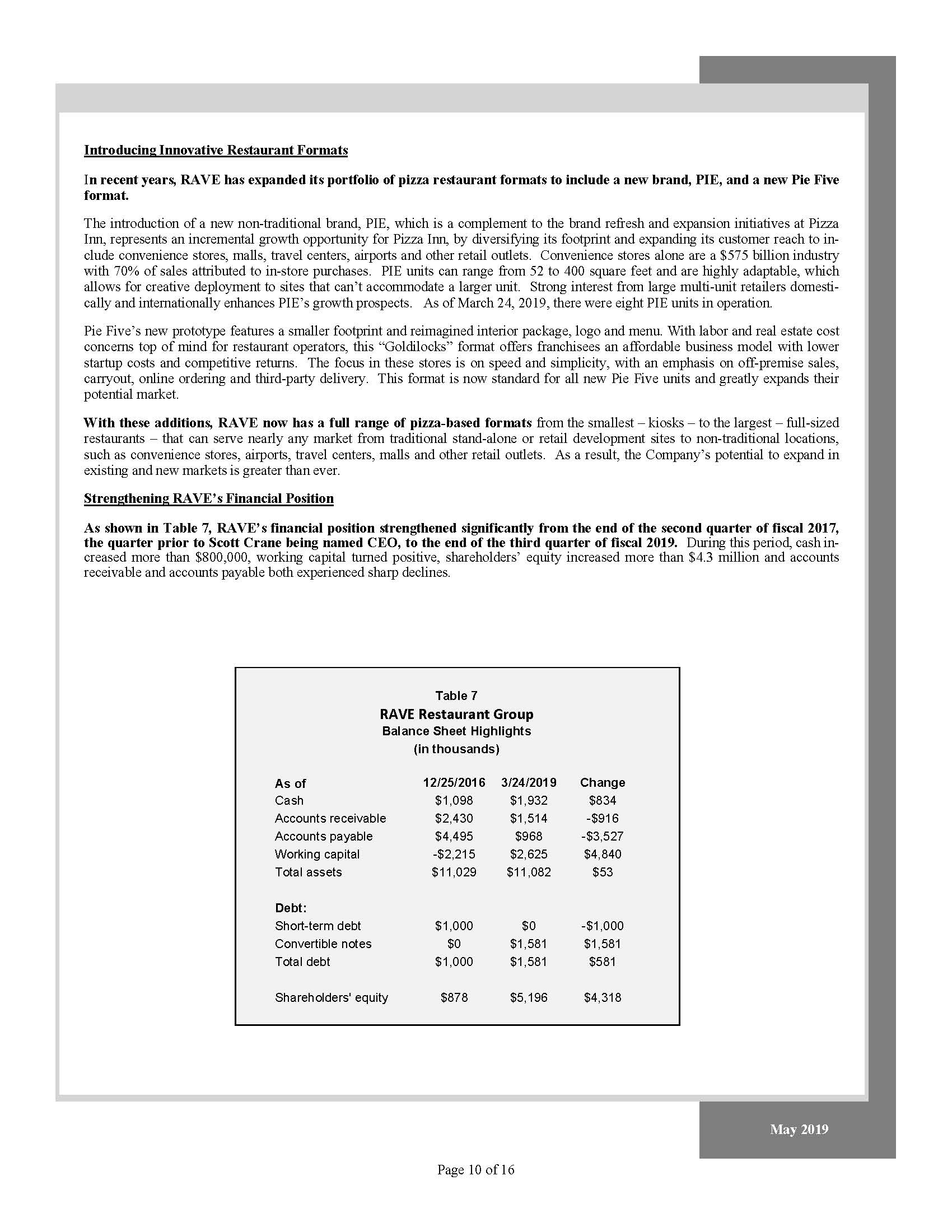

to non-traditional locations, such as convenience stores, airports, travel centers, malls and other retail outlets. As a result, the Company’s potential to expand in existing and new markets is greater than ever.Strengthening RAVE’s

Financial PositionAs shown in Table 7, RAVE’s financial position strengthened significantly from the end of the second quarter of fiscal 2017, the quarter prior to Scott Crane being named CEO, to the end of the third quarter of fiscal 2019.

During this period, cash in- creased more than $800,000, working capital turned positive, shareholders’ equity increased more than $4.3 million and accounts receivable and accounts payable both experienced sharp

declines. Table 7RAVE Restaurant GroupBalance Sheet Highlights(in

thousands) As

of 12/25/2016 3/24/2019 Change Cash $1,098 $1,932 $834 Accounts receivable $2,430 $1,514 -$916 Accounts payable $4,495 $968 -$3,527 Working capital -$2,215 $2,625 $4,840 Total

assets $11,029 $11,082 $53 Debt:Short-term debt $1,000 $0 -$1,000 Convertible notes $0 $1,581 $1,581 Total debt $1,000 $1,581 $581 Shareholders' equity $878 $5,196 $4,318 May 2019 10

Strengthening RAVE’s Financial Position (Cont.)This improvement resulted from a number

of steps taken by the Company to boost working capital, reduce ongoing capital requirements, and raise equity, including:Elimination of the Norco distribution division, which resulted in sharply lower accounts receivable and accounts

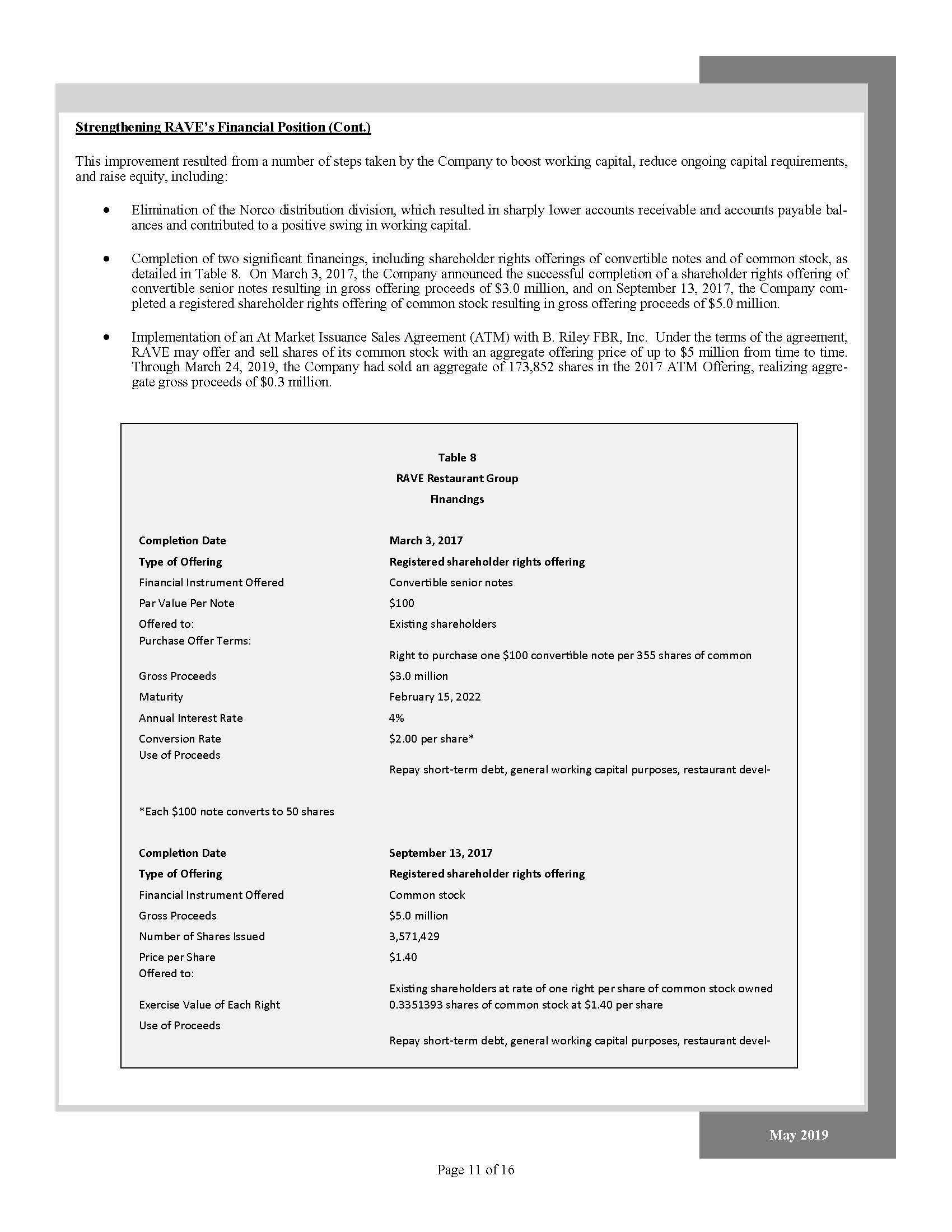

payable bal- ances and contributed to a positive swing in working capital.Completion of two significant financings, including shareholder rights offerings of convertible notes and of common stock, as detailed in Table 8. On March 3, 2017,

the Company announced the successful completion of a shareholder rights offering of convertible senior notes resulting in gross offering proceeds of $3.0 million, and on September 13, 2017, the Company com- pleted a registered shareholder

rights offering of common stock resulting in gross offering proceeds of $5.0 million.Implementation of an At Market Issuance Sales Agreement (ATM) with B. Riley FBR, Inc. Under the terms of the agreement, RAVE may offer and sell shares of

its common stock with an aggregate offering price of up to $5 million from time to time. Through March 24, 2019, the Company had sold an aggregate of 173,852 shares in the 2017 ATM Offering, realizing aggre- gate gross proceeds of $0.3

million. Table 8RAVE Restaurant Group Financings March 3, 2017Registered shareholder rights offeringConvertible senior notes$100Existing

shareholders Completion Date Type of OfferingFinancial Instrument Offered Par Value Per NoteOffered to:Purchase Offer Terms: Right to purchase one $100 convertible note per 355

shares of commonGross Proceeds $3.0 millionMaturity February 15, 2022Annual Interest Rate 4%Conversion Rate $2.00 per share*Use of ProceedsRepay short‐term debt, general working capital purposes, restaurant devel‐*Each $100 note converts to

50 shares September 13, 2017Registered shareholder rights offeringCommon stock$5.0 million 3,571,429$1.40 Completion Date Type of OfferingFinancial Instrument Offered Gross

ProceedsNumber of Shares Issued Price per ShareOffered to: Existing shareholders at rate of one right per share of common stock ownedExercise Value of Each Right 0.3351393 shares of common stock at $1.40 per shareUse of

ProceedsRepay short‐term debt, general working capital purposes, restaurant devel‐ May 2019 11

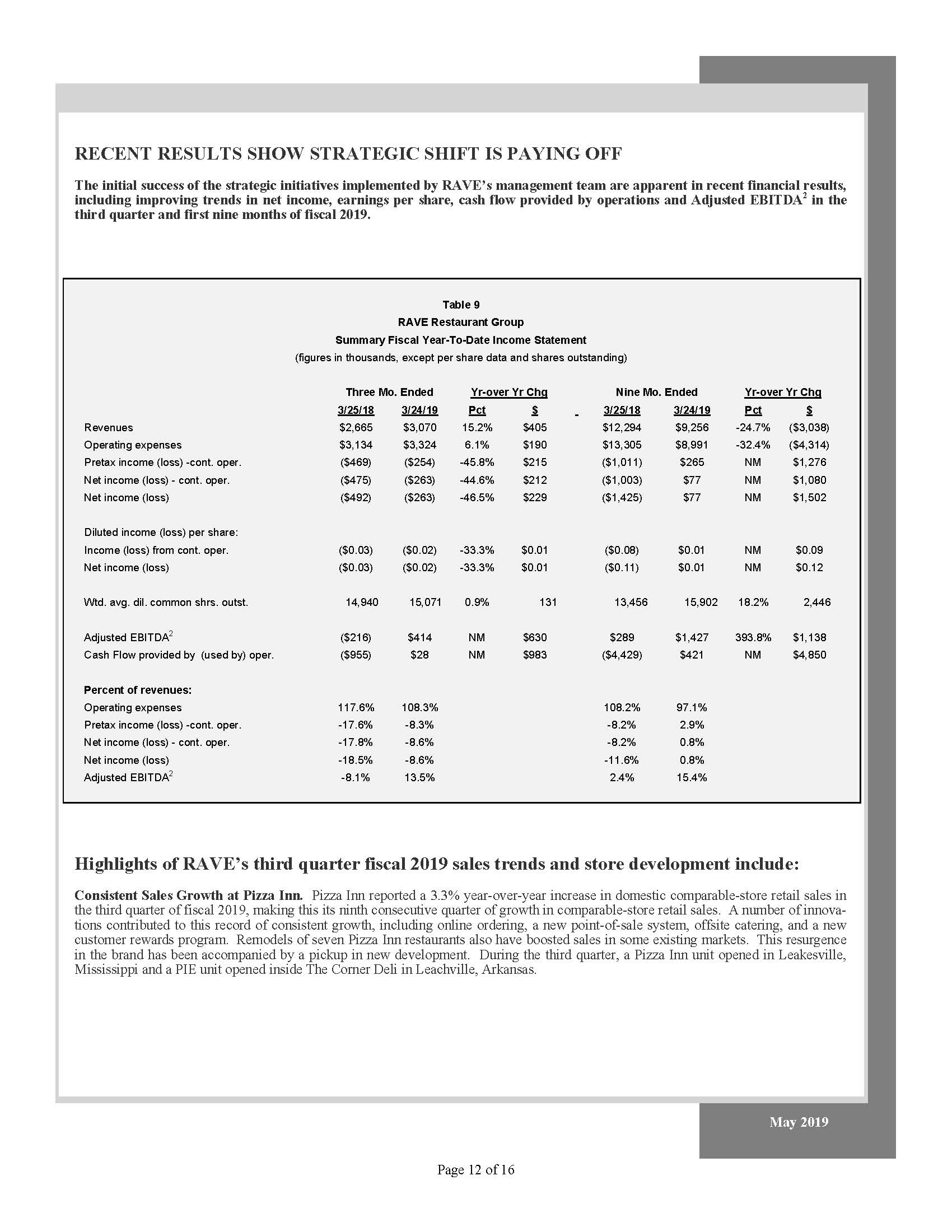

May 2019 RECENT RESULTS SHOW STRATEGIC SHIFT IS PAYING OFFThe initial success of the

strategic initiatives implemented by RAVE’s management team are apparent in recent financial results, including improving trends in net income, earnings per share, cash flow provided by operations and Adjusted EBITDA2 in the third quarter

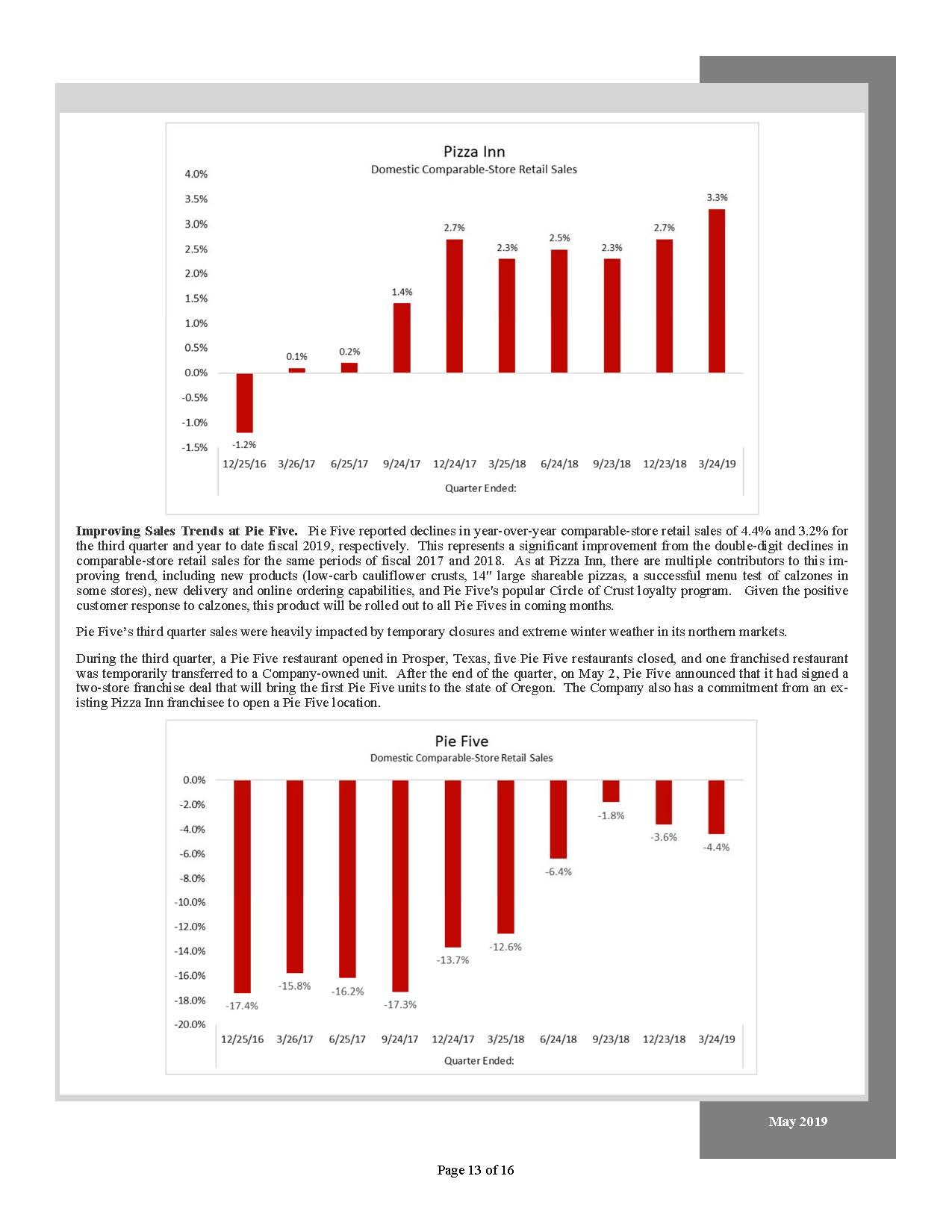

and first nine months of fiscal 2019. Highlights of RAVE’s third quarter fiscal 2019 sales trends and store development include:Consistent Sales Growth at Pizza Inn. Pizza Inn reported a 3.3% year-over-year increase in domestic

comparable-store retail sales in the third quarter of fiscal 2019, making this its ninth consecutive quarter of growth in comparable-store retail sales. A number of innova- tions contributed to this record of consistent growth, including

online ordering, a new point-of-sale system, offsite catering, and a new customer rewards program. Remodels of seven Pizza Inn restaurants also have boosted sales in some existing markets. This resurgence in the brand has been accompanied

by a pickup in new development. During the third quarter, a Pizza Inn unit opened in Leakesville, Mississippi and a PIE unit opened inside The Corner Deli in Leachville, Arkansas. Table 9RAVE

Restaurant GroupSummary Fiscal Year-To-Date Income Statement(figures in thousands, except per share data and shares outstanding) Nine Mo. Ended Yr-over Yr

Chg Revenues Operating expensesPretax income (loss) -cont. oper. Net income (loss) - cont. oper. Net

income (loss) Three Mo. Ended Yr-over Yr Chg 3/25/18 3/24/19 Pct $$2,665 $3,070 15.2% $405$3,134 $3,324 6.1% $190($469) ($254) -45.8% $215 ($475) ($263) -44.6% $212 ($492) ($263) -46.5% $229 3/25/18$12,294$13,305

($1,011)($1,003)($1,425) 3/24/19 Pct $$9,256 -24.7% ($3,038)$8,991 -32.4% ($4,314)$265 NM $1,276$77 NM $1,080$77 NM $1,502 Diluted income (loss) per

share: Income (loss) from cont. oper. Net income (loss) ($0.03) ($0.02) -33.3% $0.01($0.03) ($0.02) -33.3% $0.01 ($0.08)($0.11) $0.01$0.01 NM NM $0.09$0.12 Wtd. avg. dil. common shrs.

outst. 14,940 15,071 0.9% 131 13,456 Adjusted EBITDA2Cash Flow provided by (used by) oper. ($216)($955) $414$28 NM NM $630$983 $289

($4,429) 15,902 18.2% 2,446$1,427 393.8% $1,138$421 NM $4,850 Percent of

revenues:Operating expensesPretax income (loss) -cont. oper.Net income (loss) - cont. oper. Net income (loss)Adjusted EBITDA2 117.6% 108.3%-17.6% -8.3%-17.8% -8.6%-18.5% -8.6%-8.1%

13.5% 108.2%-8.2%-8.2%-11.6%2.4% 97.1%2.9%0.8%0.8%15.4% 12

May 2019 Improving Sales Trends at Pie Five. Pie Five reported declines in year-over-year

comparable-store retail sales of 4.4% and 3.2% for the third quarter and year to date fiscal 2019, respectively. This represents a significant improvement from the double-digit declines in comparable-store retail sales for the same periods

of fiscal 2017 and 2018. As at Pizza Inn, there are multiple contributors to this im- proving trend, including new products (low-carb cauliflower crusts, 14" large shareable pizzas, a successful menu test of calzones in some stores), new

delivery and online ordering capabilities, and Pie Five's popular Circle of Crust loyalty program. Given the positive customer response to calzones, this product will be rolled out to all Pie Fives in coming months.Pie Five’s third quarter

sales were heavily impacted by temporary closures and extreme winter weather in its northern markets.During the third quarter, a Pie Five restaurant opened in Prosper, Texas, five Pie Five restaurants closed, and one franchised restaurant

was temporarily transferred to a Company-owned unit. After the end of the quarter, on May 2, Pie Five announced that it had signed a two-store franchise deal that will bring the first Pie Five units to the state of Oregon. The Company also

has a commitment from an ex- isting Pizza Inn franchisee to open a Pie Five location. 13

May 2019 Other highlights of RAVE’s third quarter fiscal 2019 financial results include:A

third quarter revenue increase of 15% year over year to $3.1 million.Year-over-year improvement of $215,000 in pretax income/(loss) from continuing operations.A net loss of $263,000 or $0.02 per share, compared with a net loss of $492,000

or $0.03 per share in the prior-year period. The third quarter fiscal 2019 net loss was impacted by a loss on the disposal of assets, an impairment of long-lived assets and other lease charges and closed/non-operating store costs totaling

almost $400,000.Positive Adjusted EBITDA2 of $414,000, which was an improvement of $630,000 from negative Adjusted EBITDA2 of $216,000 in the prior-year third quarter.Cash flow generated by operations of $28,000, an improvement of nearly $1

million from cash used by operating activities of $955,000 million in the third quarter of fiscal 2018.Highlights of RAVE’s financial performance in the first nine months of fiscal 2019 include:A year-over-year positive swing of

approximately $1.3 million in pretax income/(loss) from continuing operations. While reve- nues declined year over year in the first nine months as a result of restaurant closings and the elimination of distribution sales, sharply lower

operating expenses more than offset this drop.Net income of $77,000 or $0.01 per share compared with a net loss of $1.4 million or $0.11 per share in the prior-year period.Adjusted EBITDA2 of $1.427 million, reflecting a positive swing of

more than $1.1 million from Adjusted EBITDA2 of $289,000 in the prior-year period.Cash flow provided by operations of $421,000, an improvement of more than $4.8 million from cash used by operating activities of more than $4.4 million in the

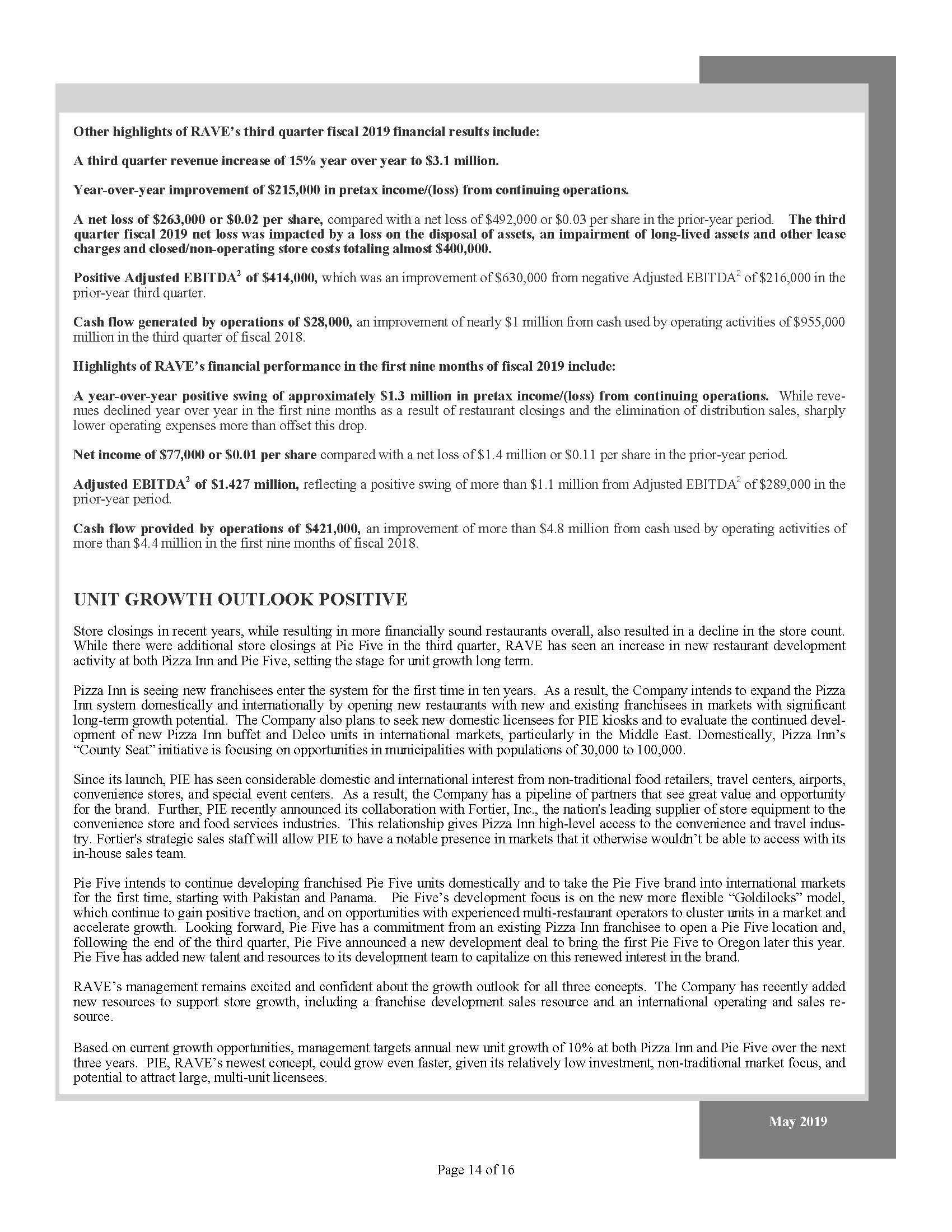

first nine months of fiscal 2018.UNIT GROWTH OUTLOOK POSITIVEStore closings in recent years, while resulting in more financially sound restaurants overall, also resulted in a decline in the store count. While there were additional store

closings at Pie Five in the third quarter, RAVE has seen an increase in new restaurant development activity at both Pizza Inn and Pie Five, setting the stage for unit growth long term.Pizza Inn is seeing new franchisees enter the system for

the first time in ten years. As a result, the Company intends to expand the Pizza Inn system domestically and internationally by opening new restaurants with new and existing franchisees in markets with significant long-term growth

potential. The Company also plans to seek new domestic licensees for PIE kiosks and to evaluate the continued devel- opment of new Pizza Inn buffet and Delco units in international markets, particularly in the Middle East. Domestically,

Pizza Inn’s “County Seat” initiative is focusing on opportunities in municipalities with populations of 30,000 to 100,000.Since its launch, PIE has seen considerable domestic and international interest from non-traditional food retailers,

travel centers, airports, convenience stores, and special event centers. As a result, the Company has a pipeline of partners that see great value and opportunity for the brand. Further, PIE recently announced its collaboration with Fortier,

Inc., the nation's leading supplier of store equipment to the convenience store and food services industries. This relationship gives Pizza Inn high-level access to the convenience and travel indus- try. Fortier's strategic sales staff will

allow PIE to have a notable presence in markets that it otherwise wouldn’t be able to access with its in-house sales team.Pie Five intends to continue developing franchised Pie Five units domestically and to take the Pie Five brand into

international markets for the first time, starting with Pakistan and Panama. Pie Five’s development focus is on the new more flexible “Goldilocks” model, which continue to gain positive traction, and on opportunities with experienced

multi-restaurant operators to cluster units in a market and accelerate growth. Looking forward, Pie Five has a commitment from an existing Pizza Inn franchisee to open a Pie Five location and, following the end of the third quarter, Pie

Five announced a new development deal to bring the first Pie Five to Oregon later this year. Pie Five has added new talent and resources to its development team to capitalize on this renewed interest in the brand.RAVE’s management remains

excited and confident about the growth outlook for all three concepts. The Company has recently added new resources to support store growth, including a franchise development sales resource and an international operating and sales re-

source.Based on current growth opportunities, management targets annual new unit growth of 10% at both Pizza Inn and Pie Five over the next three years. PIE, RAVE’s newest concept, could grow even faster, given its relatively low

investment, non-traditional market focus, and potential to attract large, multi-unit licensees. 14

May 2019 Share OwnershipAs of December 23, 2018, directors and executive officers owned

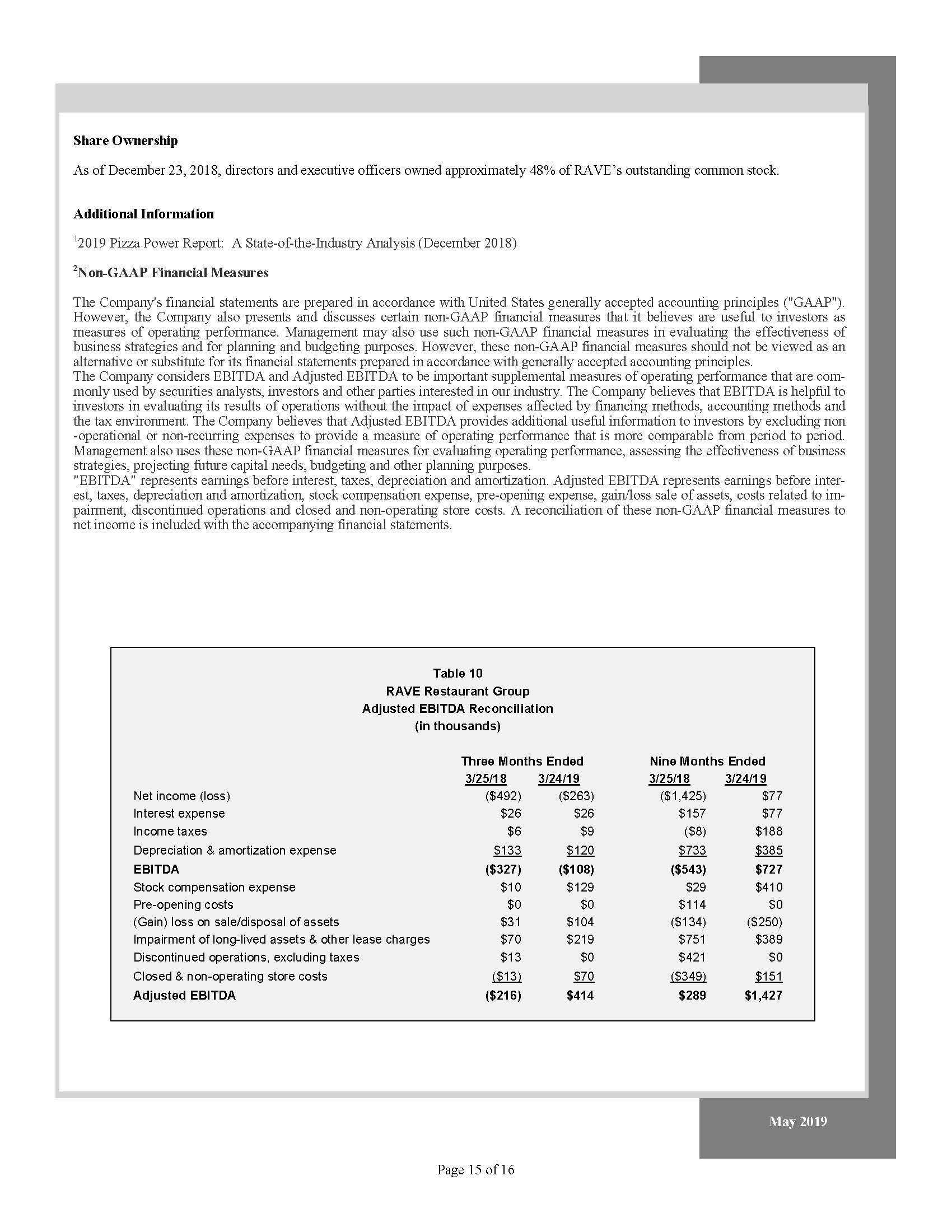

approximately 48% of RAVE’s outstanding common stock.Additional Information12019 Pizza Power Report: A State-of-the-Industry Analysis (December 2018)2Non-GAAP Financial MeasuresThe Company's financial statements are prepared in accordance

with United States generally accepted accounting principles ("GAAP"). However, the Company also presents and discusses certain non-GAAP financial measures that it believes are useful to investors as measures of operating performance.

Management may also use such non-GAAP financial measures in evaluating the effectiveness of business strategies and for planning and budgeting purposes. However, these non-GAAP financial measures should not be viewed as an alternative or

substitute for its financial statements prepared in accordance with generally accepted accounting principles.The Company considers EBITDA and Adjusted EBITDA to be important supplemental measures of operating performance that are com- monly

used by securities analysts, investors and other parties interested in our industry. The Company believes that EBITDA is helpful to investors in evaluating its results of operations without the impact of expenses affected by financing

methods, accounting methods and the tax environment. The Company believes that Adjusted EBITDA provides additional useful information to investors by excluding non-operational or non-recurring expenses to provide a measure of operating

performance that is more comparable from period to period. Management also uses these non-GAAP financial measures for evaluating operating performance, assessing the effectiveness of business strategies, projecting future capital needs,

budgeting and other planning purposes."EBITDA" represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA represents earnings before inter- est, taxes, depreciation and amortization, stock compensation

expense, pre-opening expense, gain/loss sale of assets, costs related to im- pairment, discontinued operations and closed and non-operating store costs. A reconciliation of these non-GAAP financial measures to net income is included with

the accompanying financial statements. Table 10RAVE Restaurant Group Adjusted EBITDA Reconciliation (in thousands)Three Months Ended Nine Months

Ended 3/25/18 3/24/19

3/25/18 3/24/19Net income (loss) ($492) ($263) ($1,425) $77Interest expense $26 $26 $157 $77Income taxes $6 $9 ($8) $188Depreciation & amortization expense $133 $120 $733 $385EBITDA ($327) ($108) ($543) $727Stock compensation expense

$10 $129 $29 $410Pre-opening costs $0 $0 $114 $0(Gain) loss on sale/disposal of assets $31 $104 ($134) ($250) Impairment of long-lived assets & other lease charges $70 $219 $751 $389 Discontinued operations, excluding taxes $13 $0 $421

$0Closed & non-operating store costs ($13) $70 ($349) $151Adjusted EBITDA ($216) $414 $289 $1,427 15

16 RAVE RESTAURANT GROUP INC.3551 Plano Parkway The Colony, TX 75056Phone:

469-384-5000www.raverg.comMay 2019 Note Regarding Forward-Looking StatementsCertain statements in this press release, other than historical information, may be considered forward- looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, and are intended to be covered by the safe harbors created thereby. These forward-looking statements are based on current expectations that involve numerous risks, uncertainties and assumptions.

Assump- tions relating to these forward-looking statements involve judgments with respect to, among other things, future economic, competitive and market conditions, regulatory framework and future busi- ness decisions, all of which are

difficult or impossible to predict accurately and many of which are beyond the control of RAVE Restaurant Group, Inc. Although the assumptions underlying these for- ward-looking statements are believed to be reasonable, any of the

assumptions could be inaccurate and, therefore, there can be no assurance that any forward-looking statements will prove to be accu- rate. In light of the significant uncertainties inherent in these forward-looking statements, the inclu-

sion of such information should not be regarded as a representation that the objectives and plans of RAVE Restaurant Group, Inc. will be achieved.